Блог

Наши наблюдения, идеи и новости инвестиционного мира

- 30.05.2012

- Категории: Аналитика

- Метки: альтернативные инвестиции, хедж фонды

Somehow the entire alternative investment trading universe, including both investment managers and their different funds, has wound-up being known as ‘hedge funds’. This nomenclature is still inappropriately used with a negative connotation. We have had to explain to clients and and our wide network of outside agents that the name hedge fund is first of …

On my recent trip to Switzerland, I sat down with Sander Bressers, Senior Portfolio Manager for the LGT Commodity Active Fund. I began by asking him for an overview of the Fund. SB — The fund in its present form is quite new, having been up until recently a managed account on behalf of the …

- 25.05.2012

- Категории: Инвестиционные идеи

- Метки: монголия

Mongolia is quickly becoming one of the world’s most promising economies. This frontier market in resource rich Central Asia is expected to grow by 20-23% in 2012 with strong prospects to continue this growth trend. Only Iraq has a comparable 20-year growth forecast. Mongolia’s vast territory borders the world’s premier emerging market, China. This territory …

Mongolia: The World’s Fastest Growing Economy Читать далее »

- 15.05.2012

- Категории: Аналитика, Новости

- Метки: германия, греция, золото, китай, обзор рынка, португалия, россия, сша

Китай – национальное правительство заявило, что, судя по показаниям внутреннего спроса, товарный избыток почти вдвое превысил индустриальные ожидания. Результаты свежих исследований показывают, что после февральского дефицита в 31,5 млрд. долларов США излишки имеют место уже второй месяц подряд. Российский центробанк в очередной раз уже пятый месяц подряд отказался от снижения процентных ставок, что свидетельствует о …

In the early 1990s, Russia emerged from decades of socialism into the world economy as an undercapitalized new target for investors. Those investors who were willing to accept the risks Russia presented during its decade of transition were able to earn large returns on their investments. Today, Russia is no longer such a “frontier market” …

- 10.05.2012

Quantitative easing (QE) seems like a magic remedy whereby central bankers conjure up money out of thin air and use it to purchase assets. Such activity has the capacity to transfer toxic debt, stimulate demand for risk assets, devalue currencies – thus deflating debt – and maintaining low interest rates on government securities. The European …

A flat reading from the jobs market sank stocks and plunged the Nasdaq to its biggest single-session drop since November. The Nasdaq Composite careened 67.96 points, or 2.3%, to 2956.34. Friday’s losses punctuated what was the biggest weekly decline for the technology-heavy benchmark, which fell 3.7% this week, its steepest weekly loss in since December. …

“Sell in May and go away” is strategy that some investors are likely contemplating right now. The adage is based on the historically weaker performance of stocks during the May through October time period. Adherents shift from stocks to cash at the beginning of May and then invest back into stocks at the start of …

- 25.04.2012

- Категории: Аналитика

- Метки: долговой кризис, европа, китай, кризис, кризис в европе, обзор рынка, сша

The U.K. is officially back in recession. Preliminary figures show the economy contracted 0.2% in Q1. The figures confirm analysts’ fears of a double-dip recession. The U.K. was last in recession in 2009 and, despite a strong 2010, has failed to recover in the way many had hoped. The economy has shown no growth over …

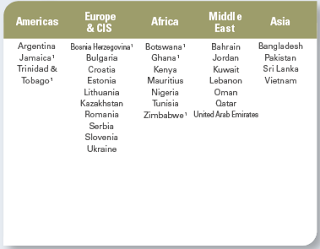

Futures trading using Commodity Trading Advisors (CTA) is currently one of the most popular hedge fund strategies. CTA/managed futures funds invest in exchange-traded futures and over-the-counter forward contracts. Fund managers use either a discretionary or systematic approach to futures trading. Discretionary managers rely heavily on their experience and personally evaluate investment decisions based on their …